Quorn has been - for over 30 years - the case study that everyone in the food industry can learn from. Its successful creation of a new category, based on patented technology, was a rare and inspiring example. Now it's a case study of how, when consumer trends turn, even successful businesses can go sour.

Quorn has been around since 1985 and is the number one branded meat alternative in Europe. It has a 32% market share in the UK, Europe's biggest meat substitute market after Germany.

Its products use mycoprotein, which is made by fermenting a fungus called fusarium venenatum. It markets a range of more than 100 products including nuggets, fishless fillets, faux ham and ‘chicken-free slices’, as well as sausages, burger patties and mince.

Quorn has focused strongly on creating products that meet consumer expectations for taste and texture and on convenience and versatility. It is the reference for “how to do it right” in meat substitutes. And it has been consistently profitable since the 1990s.

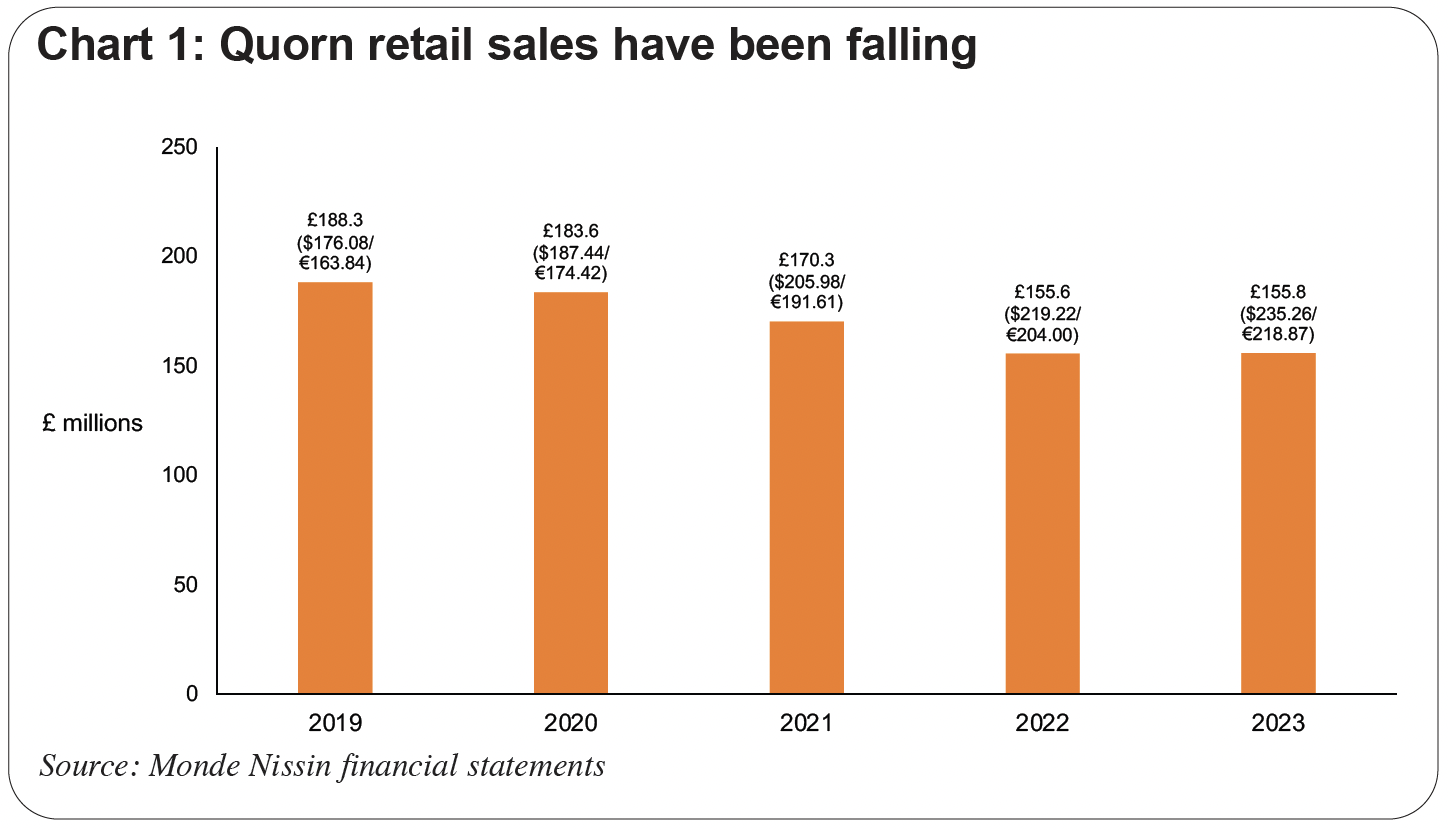

However, even Quorn has run into a ceiling on its sales and in 2023 it made a loss of over £10 million ($13.08 million) - the first loss since the early 1990s. According to Quorn’s parent, Monde Nissin, Quorn also made an operating loss of 6.5% in the first quarter of 2024.

Retail sales of meat substitutes are falling - UK retail sales of meat alternatives were down by 9.7% in the year to May 2024, according to Nielsen supermarket data.

The consumer is turning away from multi-ingredient, highly-processed meat substitutes in favour of foods that are more "real". The habit of meat-reducing - which grew from about 2012-22 - is also stalled. Millenials may stay loyal to the "plant-based is best" belief, but among Gen Z meat consumption is actually increasing. Our own research found about 5% of consumers in our 5-country survey saying they were consuming more red meat for health and nutrition.

In a bid to turn itself around Quorn has been slashing headcount and costs. There will be a lot more of that to come as the meat substitute category shrinks for the next 2-3 years. Meat substitutes are expensive to make - they are energy-intensive and use many processing steps and many ingredients - and tighter consumer budgets for the next few years will weigh against them.