For the past 40 years the food industry has focused on taking out fats from foods – particularly saturated fats. For the next 40 years we may be working on how to add them back – or at least leave alone what is naturally present. Why? Because an increasing proportion of consumers are losing their fear of fat.

This is partly thanks to the emergence of a strong body of science that tells us that we do not, after all, need to fear fat, and partly thanks to the discovery that fats play a vital role in many aspects of healthy human function. And that may just be the tip of the iceberg.

A new report from consumer insights firm HealthFocus International confirms this shift, concluding that “the old ‘low-fat’ mindset is out—and informed choices are in. Today’s shoppers know that not all fats are created equal, and they're actively seeking out healthier options in the foods and beverages they buy.”

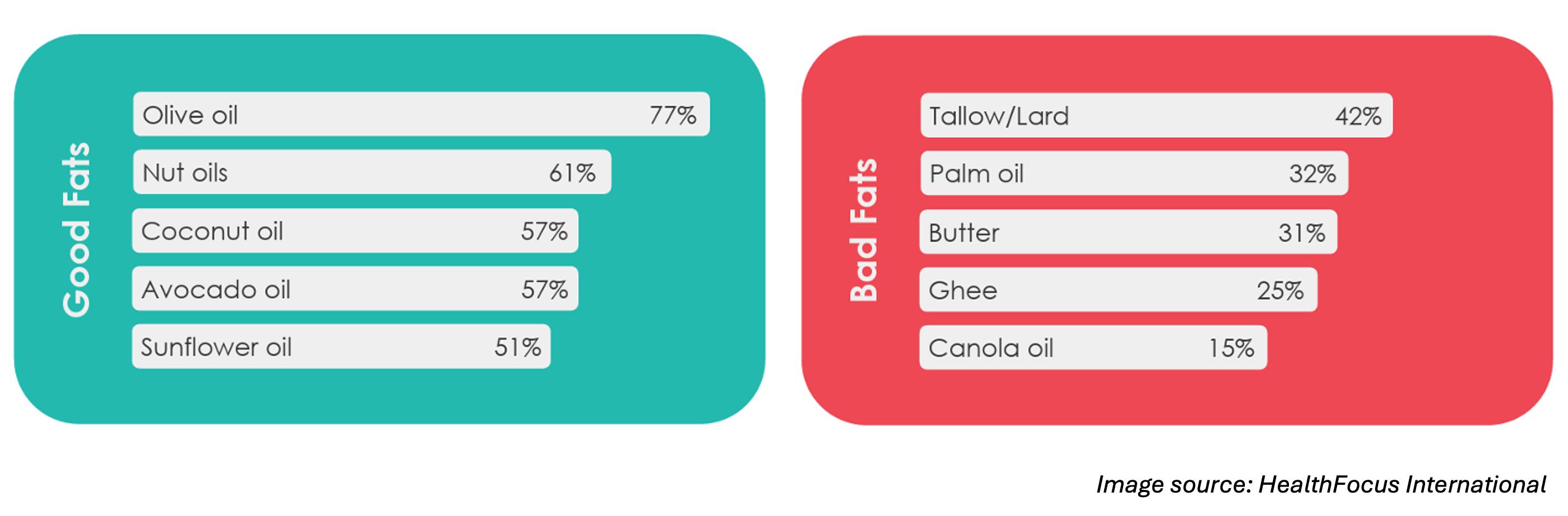

The report asked over 13,000 consumers in 25 markets about their perceptions of fat, including consumer ratings on 15 different fats and oils.

Olive oil scored the highest in terms of consumer perception, with 77% of respondents identifying it as a ‘good’ fat. This aligns with the findings from NNB’s 2025 Consumer Survey, where 89% of consumers identified olive oil as a ‘healthy’ fat. HealthFocus International also found that oil from nuts, coconut, avocado and sunflower did well, with over half of consumers considering those to be good fats.

Conversely, fats such as tallow/lard, palm oil, butter, ghee and canola oil have a less positive image in consumers’ minds. 42% of respondents in HealthFocus International’s survey said they consider tallow/lard to be a ‘bad’ fat, while 32% said the same about palm oil and 31% about butter. However, as many people said that they consider butter to be a good fat, indicating a growing curiosity about traditional fats.

The rebirth of fat has only just begun, and 45% of the consumers asked still claimed to prioritise reducing fat in their diet. This made fat reduction the second biggest priority, after reducing sugar (57%) and ahead of increasing fibre (41%). Still, slow change is still change and NNB’s research indicates that especially younger consumers are losing their fear of fat – meaning that this is a trend with steady, long-term potential.